Technical documentation

Before you start

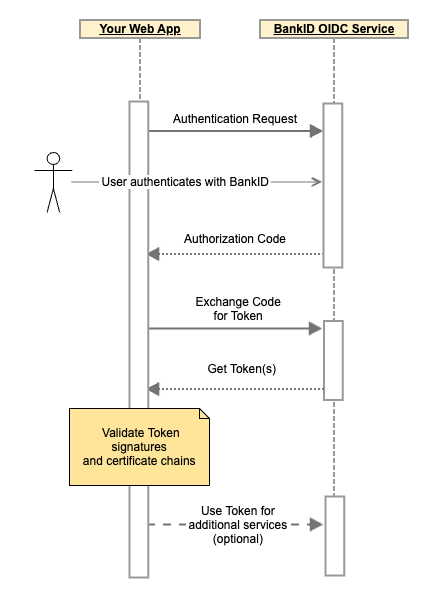

Authorization Code flow with Proof Key for Code Exchange (PKCE)

Authorization Request

- Connect to the discovery endpoint to get the OpenID configuration.

Note: Make sure to keep the response updated every so often (at least daily).

For the public test environment (CURRENT) the Discovery endpoint is:

https://auth.current.bankid.no/auth/realms/current/.well-known/openid-configuration.

See all environments. - Use the

authorization_endpointfound in the Discovery endpoint response.

Note: Do not hard code this value. Retrieve the config regularly from the OIDC discovery endpoint, as it may change. - Generate a random value for

stateand store it in your user session.- The value must be non-guessable (e.g. GUID) and unique for each request.

- This value will be used to mitigate cross-site request forgery, but it can also be used by your application to link the callback request to the end-user session alongside a cookie.

- Generate a random value for

nonceand store it in your user session.- The value must be non-guessable, cryptographically random (your framework/language most likely have support for this) and unique for each request.

- This will be used to verify integrity of ID token and mitigate replay attacks.

- Generate

code_verifierfor PKCE flow and store this in your user session.- This is a cryptographically random string using the characters A-Z, a-z, 0-9, and the punctuation characters -._~ (hyphen, period, underscore, and tilde), between 43 and 128 characters long.

- This will be used to generate a code challenge (6) and during Token exchange later.

- Generate

code_challengefrom thecode_verifierby generating a Base64-URL-encoded string of the SHA256 hash of the code verifier. - (Optional) Add any

login_hintto the request to pre-select IDP or pre-fill user information. If user information is used we recommend using an encrypted request object. - Finally, we can build the authorization URL by adding the following query parameters (see authorize for more options):

client_id: Your assigned client ID with BankID OIDC.scope: Comma separated list of scopes that indicate which information and resources you request access to. In the example below, we useopenidandprofileto get a regular ID token.redirect_uri: URI to your server-side callback endpoint where you want to receive the callback response from the BankID OIDC service. This URL must be pre-registered with BankID OIDC.response_type: Determines message flow. Only "code" is supported.state: Your generated value forstate.nonce: Your generated value fornonce.code_challenge: Your generatedcode_challenge.code_challenge_method=S256- (optional)

login_hint: Addlogin_hinthere if applicable

Example Authorization RequestGET authorization_endpoint ?client_id=your-client-id &scope=openid+profile &redirect_uri=https%3A%2F%2Fmywebapp.example.org%2Fcallback &response_type=code &state=01e3ac8e-4a26-4dfb-79ca-2631394c4144 &nonce=1fb72f68-1bea-2ba2-12d7-24df1c999d1b &code_challenge=ixDBJg7pc3yT2h65DRvhjIbGko7U-t3cYVJmdMF-hTU &code_challenge_method=S256 &login_hint=BID

- Redirect end-user to the built authorization URL to start BankID Authentication.

Authorization Code callback

If authentication is successful, the end-user will be redirected to your application at the given redirect_uri with state and code as parameters.

- Verify that the

stateparameter returned corresponds to thestateparameter for your user session. Do a POST request to the token_endpoint with the provided code to get the ID token, Access token and Refresh token.

Example request

Example Token RequestPOST /auth/realms/current/protocol/openid-connect/token HTTP/1.1 Host: auth.current.bankid.no Authorization: Basic b2lkYy10ZXN0Y2xpZW50OjAxMjM0NTY3LTg5YWItY2RlZi0wMTIzLTQ1Njc4OWFiY2RlZg== Content-Type: application/x-www-form-urlencoded grant_type=authorization_code &client_id=your-client-id &code=code=authorization-code-from-callback &redirect_uri=https%3A%2F%2Fmywebapp.example.org%2Fcallback &code_verifier=your-code-verifier

- Important: Perform Token validation

Verify the signature of the JWS tokens received and check the certificate chain of the signing key used by following this guide.

- Check claims by following this guide.

- Once validation is complete, you can access the claims in the various tokens:

- The ID token contains claims that can be used to identify the end-user. See ID token for available claims.

- The Access token can be used to access additional services such as document signing or additional user information (5).

- (optional) Fetch additional Userinfo through userinfo_endpoint.

- Use the access token you received in the previous step as Bearer token in the userinfo request

- Use the

userinfo_endpointfound in the Discovery endpoint response. - The Userinfo response comes in JWS format so you need to perform signature validation here as well.

If authentication is cancelled (due to user action or errors)

If error is part of the query parameters, the authentication was not completed, you need to handle the error.

- The possible ASCII values for the

errorquery parameter is defined in the specification for OIDC (§3.1.4.6) or OAuth 2.0 (RFC 6749, §4.1.2.1). - If the end-user cancels an authentication request in the BankID OIDC client,

errorwill have the valueaccess_denied. - In addition to

error, the response parametererror_descriptionmay include BankID error codes the end-user experienced.

Next steps

Read up on how we do Key rotation and how you can do Token verification.

Our APIs are continuously adding new changes and features in API Versions and Changelog.

The list of error codes displayed to the end-user is useful for troubleshooting.

Known issues contains a list of restrictions, caveats and known problems.

The Deprecations list is also interesting to keep an eye on.